How to pay CRA

The CRA has provided the following link describing exactly how and which payees to use within online banking.

LINK - Please click "Businesses" at the top of the page.

Step 1

Ensure your bank supports this service from the dropdown in the CRA link above.

Step 2

Login to your online banking and find "Tax filing" or "Tax Services" or "Tax Filing Services"

Step 3

Enter your full name and phone number

Step 4

Click "Tax Filing Service"

Step 5

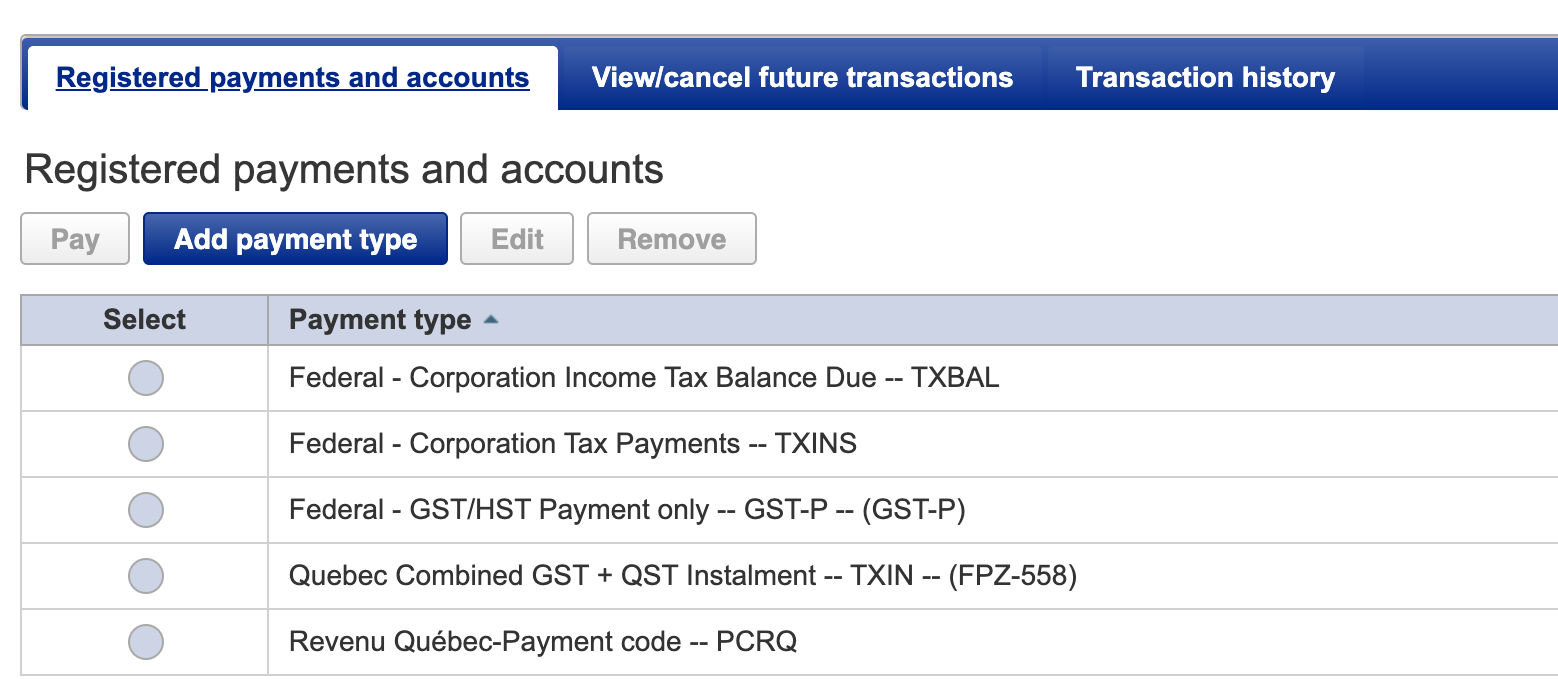

Select "Add payment type"

Step 6

Search for the payment types as listed in Step 9.

Step 7

Enter your tax account number. If this is a CRA account number, enter your BN number followed by the correct code (RC0001 for corp tax / RT0001 for sales tax). Note: In Quebec, sales tax for both federal and provincial is only paid to Revenu Quebec.

Step 8

Enter the correct filing period depending on the payment type you are making.

Step 9

The following list is all you will need.

1. CRA corp income tax due

2. CRA corp income tax instalments

3. GST/HST payment for amount due and can be used for instalments as well

4. GST+QST instalments

5. Revenu Quebec payment code for GST/QST filings, sometimes GST/QST instalments and Quebec corp tax.